As financial crimes and disputes continue to rise, the demand for forensic accounting services has never been greater. The Pineville, Louisiana CPA receives specialized training in forensic accounting to help investigate financial irregularities, detect and prevent financial crimes, and provide expert testimony in court. The role of CPAs in forensic accounting is multifaceted, requiring a unique blend of accounting, auditing, and investigative skills.

In this article, we’ll explore the critical role that CPAs play in forensic accounting, and how their expertise can help resolve financial disputes and bring perpetrators of financial crimes to justice.

What is Forensic Accounting?

Forensic accounting is a multidisciplinary field that combines accounting, auditing, and investigative skills to analyze financial data and provide expert opinions. Forensic accountants use their skills to investigate financial irregularities, detect and prevent financial crimes, and provide expert testimony in court.

Who is a CPA?

A Certified Public Accountant (CPA) is a highly trained and licensed professional who specializes in accounting and finance. CPAs are qualified to provide a wide range of accounting services, including financial planning, tax preparation, auditing, and financial reporting. They are also bound by a strict code of ethics, which ensures that they maintain the highest standards of professionalism and integrity in their work.

What is The Role of CPAs in Forensic Accounting?

CPAs play a critical role in forensic accounting, bringing their expertise and knowledge to help investigate financial irregularities, analyze financial data, and provide expert opinions. Some of the key roles that CPAs play in forensic accounting include:

- Investigating Financial Irregularities: CPAs use their accounting and auditing skills to investigate financial irregularities, such as embezzlement, financial statement fraud, and other types of financial crimes.

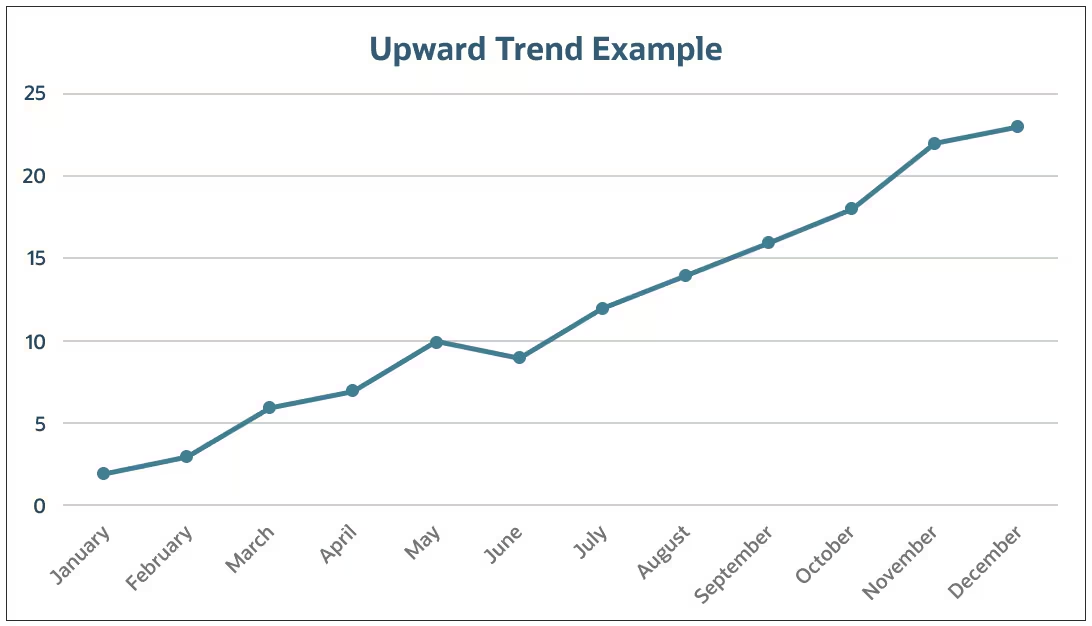

- Analyzing Financial Data: CPAs use their analytical skills to analyze financial data, identify trends and patterns, and provide expert opinions on financial matters.

- Providing Expert Testimony: CPAs provide expert testimony in court, helping to explain complex financial concepts to judges, juries, and other stakeholders.

- Developing and Implementing Financial Controls: CPAs help organizations develop and implement financial controls, such as internal controls and accounting policies, to prevent financial irregularities and ensure the accuracy and reliability of financial data.

What Are The Benefits of Using a CPA in Forensic Accounting?

There are several benefits to using a CPA in forensic accounting, including:

- Expertise and Knowledge: CPAs have the expertise and knowledge to investigate financial irregularities, analyze financial data, and provide expert opinions.

- Independence and Objectivity: CPAs are independent and objective, providing unbiased opinions and recommendations.

- Communication Skills: CPAs have excellent communication skills, helping to explain complex financial concepts to non-financial stakeholders.

- Professional Credibility: CPAs have professional credibility, providing expert testimony and opinions that are respected by judges, juries, and other stakeholders.

What Are The Common Forensic Accounting Services Provided by CPAs?

CPAs provide a range of forensic accounting services, including:

- Financial Statement Analysis: CPAs analyze financial statements to identify trends and patterns, and to detect financial irregularities.

- Fraud Investigation: CPAs investigate allegations of fraud, including embezzlement, financial statement fraud, and other types of financial crimes.

- Litigation Support: CPAs provide litigation support, including expert testimony and opinions, to help resolve financial disputes.

- Risk Assessment and Management: CPAs help organizations assess and manage financial risks, including the risk of financial irregularities and financial crimes.

Final Thought

Forensic accounting is a specialized field of accounting that involves the use of accounting, auditing, and investigative skills to help resolve financial disputes, detect and prevent financial crimes, and provide expert testimony in court. CPAs play a critical role in forensic accounting, bringing their expertise and knowledge to help investigate financial irregularities, analyze financial data, and provide expert opinions.

By using a CPA in forensic accounting, organizations can benefit from expertise and knowledge, independence and objectivity, communication skills, and professional credibility.