When looking for a dentist or a dental clinic, it is always important to make the right decision. However, the decision-making process can be tricky as many dentists are available in Singapore. Not getting your oral health checked can lead to major health complications. Also, many of them delay their treatment which leads to more complications. Instead of wasting time, it is important to look for the right dental clinic from the Greenlife dental price list and book a slot. To proceed, you should consider the below-listed parameters and hire a licensed dentist.

-

A Personal Decision

Do the thought of visiting a well-known and experienced dentist make you anxious? If so, you should first relax and feel like they are your partner. But it will only happen if you visit a licensed and reputed dentist. You can go for routine oral health check-ups and get the right treatment. In that way, you can prevent dental diseases and reduce other health risks like cardiovascular diseases.

-

Get Some Reference From Your Family And Friends

Most of them need to visit a dentist at some point in time. To start with the research process, you should always prepare a list of potential dentists operating in Singapore. You can start asking your friends, relatives, family members, and other healthcare providers for referrals. In addition, you can conduct online research to find out about dentists in Singapore. Once you have the list, you can call the dentist and book a consultation.

-

Finding Out The Credentials Of The Dentist

The next parameter is to determine the dentist’s credentials by researching them. It reveals the details of the dentist’s necessary skills, training, and experience. Along with all these details, you should check if they have any history of malpractice or other disciplinary actions. Also, look for training hospitals, medical schools, and certifications to decide whom to visit.

-

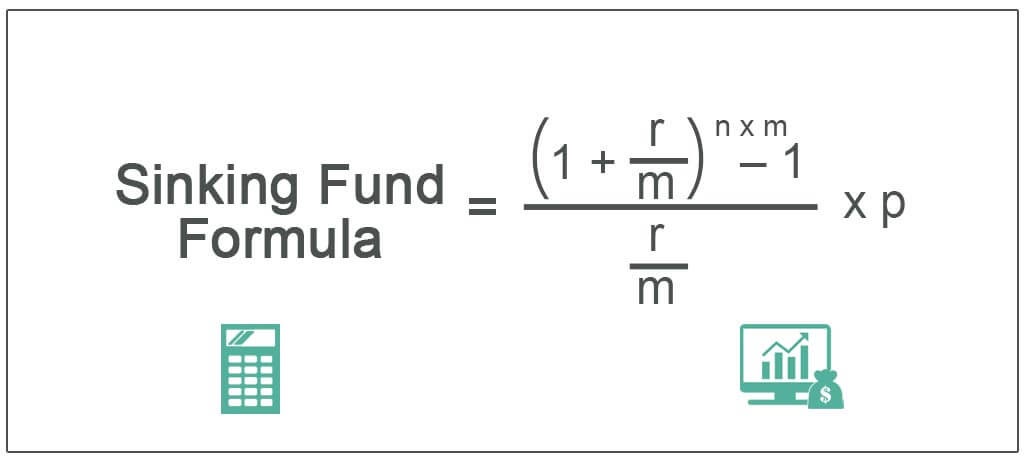

The Different Payment Options Available

Many individuals prefer to use the buy now pay later in Singapore option but not every dental clinic offers this feasibility. That’s why patients must look for the wide variety of payment options available and decide which one to opt for. In this situation, they will have the feasibility to make payments according to their wish.

-

Finding The Right Insurance Policy

Buyers should look for the right insurance policy and opt for one they can use whenever needed. Every insurance policy is different, so they have to be careful while getting one. Patients must compare the insurance policies offered by the top insurance companies to make a choice. The best critical illness insurance Singapore will cover all the expenses incurred in your dental check-up.

-

Check The Experience The Dentist Holds

When visiting a dentist to improve your oral health, the experience of a dentist matters the most. The more years of experience a dentist holds, the better results patients can experience. Over these years, they have handled many patients, which has improved their expertise and skills. That way, they can improve the patient’s health by giving the right medication to them.

-

Evaluating The Communication Style Of A Dentist

Pick a dental expert with whom you are comfortable discussing your problem and who supports your requirements. You should ask a few questions on your first visit and check their response. Find if they welcome your queries thinking theirs or if they ignore them. Did you feel they are rushing to some conclusion, or will you understand and take care of your needs appropriately? Look for a dentist interested in solving your problem and paying attention to your treatment preferences. That will help in the decision-making process, and you will be able to recover quickly.

-

Is Gender A Concern?

While visiting a dentist, it is important to make yourself feel comfortable. In this regard, many of them might not think of ready to discuss the complexities of the opposite gender. In such a situation, they prefer to go with their gender. Therefore, it helps them to discuss their issues and get the necessary treatment.

-

Going Through The Reviews Written By Patients

Reading through the review section of the website will help in finding out what patients have to say about the dentist and the treatment. If they are not satisfied, there is no chance of you visiting the clinic. In short, the reviews will give a brief idea of what to do. Also, it becomes easier to eliminate the names of patients who are not up to the mark according to patients they have treated.

The Ending Note

With all the above parameters, patients can easily decide on the dental clinic and the dentist who can offer the right treatment. Besides that, they can look for insurance policies that cover all the expenses while going for an oral health check-up.