Diamonds and gemstones have held a significant place in fashion and culture. From ancient civilizations to modern times, these precious stones have symbolized wealth, power, and status. In ancient Egypt, for example, gemstones were worn as adornments and as symbols of protection and spirituality. Similarly, during the Renaissance period in Europe, diamonds became synonymous with royalty and were often featured in extravagant jewelry worn by kings and queens. The historical significance of diamonds and gemstones continues to influence fashion trends today as designers draw inspiration from the past to create timeless pieces that resonate with contemporary audiences.

Cultural influences are crucial in shaping the popularity and perception of San Francisco diamonds and gemstones in fashion. Different cultures have their traditions and beliefs surrounding these precious stones, influencing how they are worn and valued. For instance, in Indian culture, gemstones are often associated with astrology and are believed to possess mystical powers that can bring luck and prosperity to the wearer. In contrast, diamonds are commonly seen as symbols of love and commitment in Western cultures, often exchanged as engagement rings. These cultural influences not only dictate the significance of diamonds and gemstones but also impact the design and style of jewelry in various regions worldwide.

The Evolution of Diamond and Gemstone Use in Fashion

Traditional Settings and Styles

In traditional settings and styles, diamonds and gemstones have long been revered for their timeless elegance. From classic solitaire diamond rings to vintage-inspired gemstone pendants, these pieces have adorned individuals for centuries, symbolizing love, prosperity, and heritage. Traditional craftsmanship techniques, such as prong and bezel settings, continue to showcase the beauty of these precious stones, highlighting their brilliance and color in intricate designs.

Modern Trends and Innovations

Today, the landscape of diamond and gemstone fashion is marked by a fusion of tradition and innovation. Designers push boundaries with avant-garde settings, incorporating unconventional materials and geometric shapes to create striking statement pieces. Modern jewelry reflects a dynamic interplay between boldness and refinement, from asymmetrical diamond earrings to gemstone-encrusted cuffs. Moreover, technological advancements, like 3D printing and laser cutting, enable designers to experiment with intricate patterns and personalized motifs, catering to individual tastes and preferences.

Sustainable and Ethical Practices

In recent years, there has been a growing emphasis on sustainability and ethical sourcing within the diamond and gemstone industry. Consumers increasingly seek transparency and accountability, driving a shift towards ethically mined stones and eco-friendly manufacturing processes. Jewelers are embracing responsible practices, such as recycled metals and fair trade gemstones, to minimize environmental impact and support local communities. Additionally, certifications like the Kimberley Process Certification Scheme and Fairmined ensure that Los Angeles diamonds and gemstones are sourced ethically, assuring conscientious buyers.

Diamonds and Gemstones: Symbols of Status and Style

Celebrity Influence

The influence of celebrities on fashion trends cannot be overstated, and their affinity for diamonds and gemstones has only amplified their allure. From dazzling red carpet appearances to everyday street style, celebrities serve as tastemakers, showcasing the latest jewelry trends. Iconic moments, like Marilyn Monroe’s rendition of “Diamonds Are a Girl’s Best Friend” or Lady Gaga’s extravagant gemstone ensembles, have cemented diamonds and gemstones as symbols of glamour and prestige in popular culture.

Red Carpet Trends

The red carpet showcases the most exquisite diamond and gemstone creations, setting the stage for coveted trends and style inspiration. Celebrities adorn themselves with opulent jewels that captivate audiences worldwide from cascading diamond necklaces to vibrant gemstone clusters. Designers vie for the spotlight, debuting their most opulent creations on the red carpet, where every sparkle and shimmer captures the imagination of fashion enthusiasts.

Everyday Wear

Beyond the glitz and glamour of special occasions, diamonds and gemstones have found their place in everyday wear, adding a touch of luxury to daily ensembles. Whether it’s a delicate diamond pendant for the office or a colorful gemstone ring for brunch with friends, these pieces effortlessly elevate any outfit. Moreover, the versatility of diamonds and gemstones allows for seamless transitions from day to night, making them indispensable staples in the modern wardrobe.

The Science Behind the Sparkle: Understanding Cuts and Colors

Diamond Cuts and Brilliance

Diamond cuts play a pivotal role in enhancing a stone’s brilliance. The cut determines how effectively light reflects within the diamond, creating that coveted sparkle. Popular cuts like round, princess, and cushion are renowned for maximizing brilliance by allowing light to enter and refract through the facets. Each cut has unique charm and brilliance, catering to various tastes and styles.

Gemstone Colors and Meanings

Gemstone colors evoke emotions and convey symbolic meanings, adding depth to their allure. From the fiery red of rubies symbolizing passion to the serene blue of sapphires representing wisdom, each hue carries its significance. Understanding the meanings behind gemstone colors enables individuals to infuse personal narratives into their jewelry choices, making them not just accessories but reflections of identity and sentiment. Whether selecting a stone for its aesthetic appeal or its symbolic resonance, the diverse palette of gemstone colors offers endless possibilities for self-expression and style.

Choosing the Right Stone for Your Style

Selecting the perfect stone involves carefully balancing personal style, practicality, and budget considerations. Whether opting for the timeless elegance of Beverly Hills diamonds or the vibrant allure of colored gemstones, finding the right match entails understanding one’s style preferences and lifestyle needs. Factors such as durability, versatility, and overall aesthetic coherence with existing jewelry collections are pivotal in the decision-making process.

Investment Value: Why Diamonds and Gemstones are Timeless Assets

Rarity and Demand

Diamonds and gemstones have long been revered as timeless assets due to their inherent rarity and enduring demand. The finite supply of natural diamonds and certain gemstones, coupled with consistently high demand, ensures their enduring value in the market. As symbols of luxury, status, and romance, these precious stones hold a universal appeal that transcends cultural and geographical boundaries.

Market Trends and Predictions

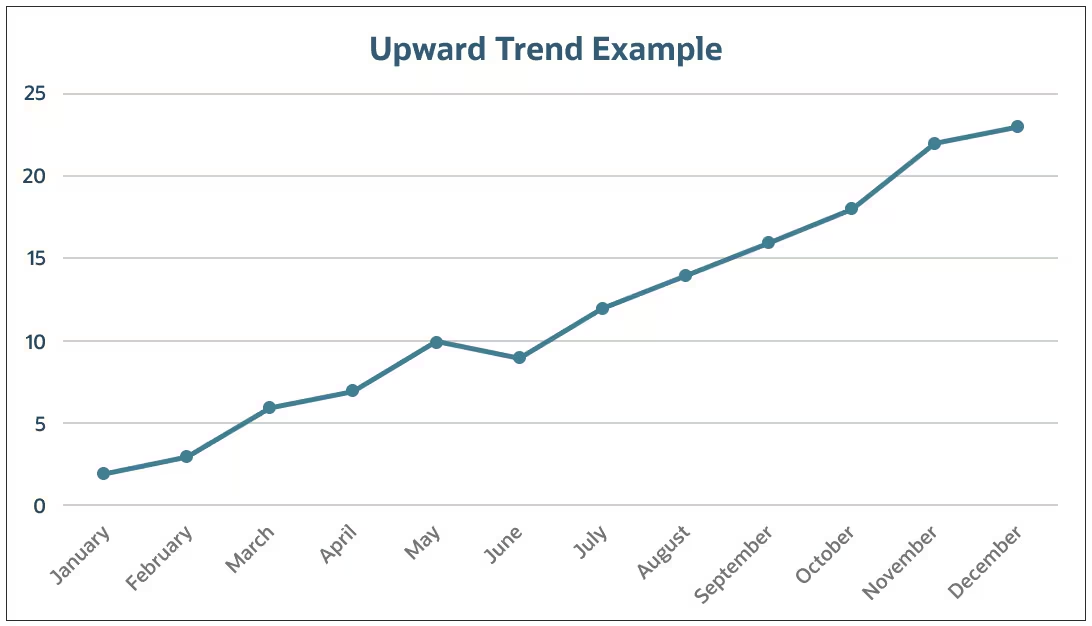

Keeping abreast of market trends and predictions is crucial for making informed investment decisions in the diamond and gemstone industry. While historical data provides valuable insights into pricing trends and demand patterns, staying attuned to emerging market dynamics and consumer preferences is equally essential. From shifts in consumer demographics to advancements in technology affecting gemstone treatments, various factors influence market trends and can impact the value of investments.

Factors Affecting Gemstone Values

Numerous factors contribute to the valuation of gemstones, ranging from intrinsic qualities such as clarity, color, and carat weight to external factors like market demand and geopolitical developments. Understanding these determinants enables investors to assess the potential return on investment and make strategic decisions regarding gemstone acquisitions. Factors like gemstone provenance, historical significance, and rarity further enhance their appeal and value.

Investment Value: Why Diamonds and Gemstones are Timeless Assets

Rarity and Demand

Diamonds and gemstones hold enduring investment value due to their inherent rarity and perpetual demand. Their scarcity in nature ensures their value appreciates over time, making them a reliable asset for investors seeking stability amidst market fluctuations.

Market Trends and Predictions

Tracking market trends and predictions is essential for investors considering diamonds and gemstones. Despite economic shifts, these assets maintain their allure, often outperforming traditional investments. Observing market dynamics helps investors make informed decisions, maximizing the potential returns on their gemstone portfolios.

Factors Affecting Gemstone Values

Various factors influence gemstone values, including carat weight, clarity, color, and cut. Additionally, factors such as rarity, provenance, and market demand play pivotal roles in determining the worth of individual gemstones. Understanding these intricacies empowers investors to navigate the gemstone market effectively.

How to Incorporate Diamonds and Gemstones into Your Wardrobe

Jewelry Pairing Tips

Consider the occasion and your outfit’s style when incorporating diamonds and gemstones into your wardrobe. Pair bold gemstone jewelry with neutral or monochromatic ensembles to make a statement, while delicate pieces complement vibrant or patterned attire. Mixing metals and gemstone colors adds depth and visual interest to your look.

Mixing and Matching with Different Outfits

Versatility is critical when mixing and matching diamonds and gemstones with different outfits. Opt for timeless classics like diamond studs or solitaire pendants for everyday wear, effortlessly transitioning from casual to formal occasions. Statement pieces, such as cocktail rings or layered necklaces, elevate evening attire, infusing glamour into any ensemble.

Creating Versatile Looks for Different Occasions

Creating versatile looks with diamonds and gemstones involves curating a diverse jewelry collection suitable for various occasions. Invest in staple pieces like tennis bracelets or gemstone studs that seamlessly complement professional attire and eveningwear. Layering delicate necklaces or stacking rings offers flexibility, allowing you to customize your look according to the event’s dress code.

Caring for Your Diamonds and Gemstones: Maintenance Tips

Cleaning and Storage Practices

Regular cleaning is essential to maintain the brilliance of your diamonds and gemstones. Use a soft brush with mild, soapy water to gently scrub away dirt and grime from the surface of the jewelry. Be cautious not to use harsh chemicals or abrasive materials that could scratch or damage the stones. After cleaning, thoroughly rinse the jewelry with clean water, and pat dry with a soft cloth to prevent water spots. When not in use, store your jewelry in a separate compartment of a jewelry box or pouch to avoid scratches and tangling with other pieces. Consider investing in a jewelry cleaning solution or ultrasonic cleaner for periodic deep cleaning to restore the shine and luster of your precious stones.

Professional Care and Inspection

While regular at-home cleaning is essential, professional care and inspection are also crucial for preserving the integrity of your diamonds and gemstones. Schedule regular visits to a reputable jeweler for professional cleaning and inspection, typically recommended every six months to a year. During these inspections, trained professionals can detect loose stones, worn prongs, or other issues that may require repair or maintenance. Additionally, professional jewelers can access specialized equipment and techniques to clean and polish your jewelry effectively without causing damage.

Avoiding Common Mistakes That Can Damage Your Jewelry

Avoid wearing your jewelry during activities that could expose it to chemicals, harsh conditions, or physical impact, such as swimming, gardening, or sports. Chemicals like chlorine and household cleaners can corrode metal settings and dull the sparkle of gemstones. Remove your jewelry before applying lotions, perfumes, or hairspray to prevent buildup and discoloration. When storing your jewelry, avoid exposure to direct sunlight or extreme temperatures, as prolonged exposure can cause fading or damage to certain gemstones. Lastly, be cautious when handling your jewelry to avoid accidental drops or impacts that could chip or scratch the stones. By following these simple precautions, you can ensure that your diamonds and gemstones remain beautiful and radiant for years.

In conclusion, diamonds and gemstones persist as enduring symbols of style and status, seamlessly blending tradition with innovation. From ancient civilizations to modern fashionistas, these precious stones captivate with their allure and elegance. As fashion evolves, so too do the trends surrounding these gems, reflecting cultural influences and sustainability efforts. Whether adorning red carpets or everyday ensembles, diamonds and gemstones remain timeless assets, cherished for their beauty and investment value.

Read More