Seasons do play a large role in small business accounting because owners need to apply necessary adjustments to make a business run effectively and become profitable throughout the year. Small business accountant in Pembroke Pines or business owners, who manage accounts in-house, should be aware of these trends, and how they affect cash flow, expenses, and revenue. In order to achieve that, businesses must be ready for changes and consequently adjust themselves so as to keep their financial stability high regardless of the specific season.

In what ways might seasonal sales affect revenue estimates?

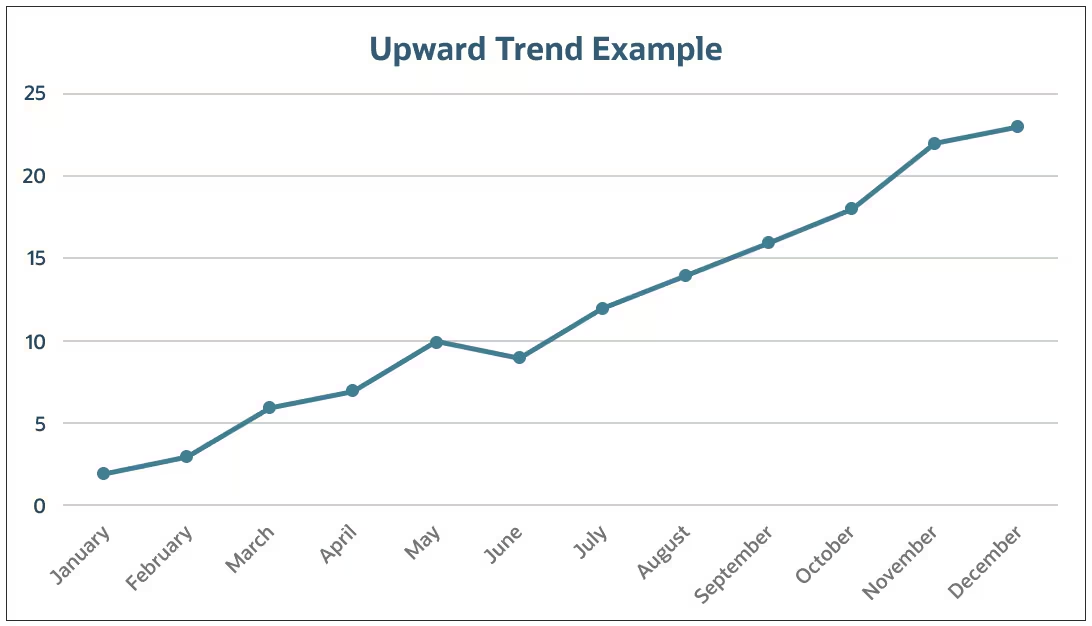

The seasonal sales patterns are therefore an evident factor that links with the revenue expectation for small businesses. Total sales during the first semester appear higher than the total sales during the second semester, therefore the two seasons depict differential sales trends.

These variations make it important for small business people to come up with revenue estimations from previous experiences and trends. By recognizing these periods of low and high activity, enterprises can budget other coming slow periods with the extra profits that come with the periods of high activity. Forecasting is very important in helping business owners avoid overstretching their available resources and at the same time guaranteeing an economic venture the much-needed profits for the entire year.

How do Seasonal Costs Affect the Accounting of a Small Business?

Employment costs, stock, and advertisement expenses during the festive season are other aspects of small business accounting. A business therefore may have to employ additional workers during periods of high business volume or increase the merchandise required to be in stock.

These are best incurred where they are within the business’s cash flow plan to avoid making financial mistakes. Likewise, selling expenses are generally greater during peak time because more consumers are and companies want more consumers. These costs must be incorporated into the company’s book of accounts so that their tracking and recording are properly done. Hence, by predicting such costs and factoring them into the business, there is a possibility to avoid undue costs.

How does taxation differ from one season to another?

Small businesses also get to experience different seasons of taxes. For instance, tax payments are often due towards the close of the year forcing business owners to balance their accounts, and check whether all expenses or all income has been recorded. The sales increase during the particular seasons results in high taxable income meaning that the business people should prepare to part with some amount as taxes.

On the other hand, the slow months may be good for carrying out proper tax planning and making necessary purchases or prepayments from the company’s funds. The awareness of how changes in seasons affect taxes helps business people plan their finances in case there are shocks during the time of filing taxes.

How Important is Seasonal Planning for the Management of Cash Flow?

Cash flow management is amongst the most important facets of managing a small business since such businesses may experience cash shortages at some times of the year. Seasonal planning helps business people to be in a better position to know when to expect cash in and when to expect short cash situations so that they can prepare for the fluctuations that are inevitable in business.

By focusing on cash control and following expenses they are able to check whether they have available cash to run the business, even during low season. The common practice is to have a float also one that is built during prosperous months for use on lean months. The cash flow management ensures that the result from the sales is effectively managed so that fluctuations that are occasioned by seasons do not affect the firm.

Conclusion

When it comes to budgeting, collection of revenues, expenses, and cash flow, seasonal fluctuations cannot be overlooked in a small business. By knowing these trends, the business owner will be in a position to be able to make the right decisions, and also he will be in a position to embrace the fluctuation of the financial situation in any year ahead. Small business management of trends is possible when all entrepreneurs develop adequate strategies to tackle these trends with the aim of ensuring sustainable profits in the long run.